Cryptocurrency trading strategies

Cryptocurrency trading strategies are very popular. These strategies permit experienced traders to make a profit simply by following a set of rules. These days an accurate trade is easier using different tools and, of course, wisdom. Here we will talk about some strategies to do some basic styles of trading with crypto. Please take a look at this quick article on cryptocurrency trading strategies.

All trading strategies involve some risk

Just like buying a new car, buying a cryptocurrency can be thrilling but also disappointing. Buying a cryptocurrency like Bitcoin is less of the second emotion. Since the all time high of around 14 thousand dollars, we have been seeing Bitcoin smooth out to have better stability. Even so, the objective is to buy low and sell high. The risk is there with Bitcoin. The risk is to make a quick and amateur move and lose money instead of make it. With a few helpful trades, though, things should go as smooth as butter. What the trader wants to do is look for clear breakouts of the lower prices. Knowing cryptocurrency trading strategies is to be able to find when a cryptocurrency has hit bottom. This is a sweet feeling for any trader. For this knowledge, there is something called the; “trend line”.

Watching the trend line is a typical strategy

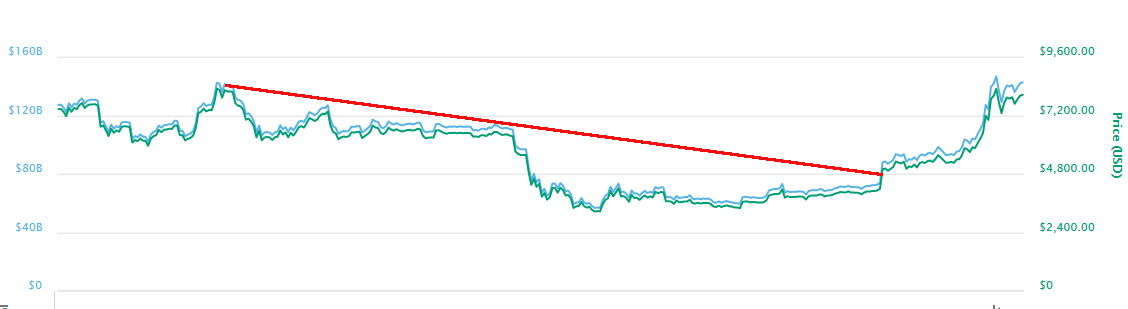

A cryptocurrency will always be going in cycles of ups and downs. Based on whatever currency you are comparing it to this “change” is a “constant”. The trend line is a straight line that extends down from the last all time high to the bottom of the most recent low. Here is a trend line “in the flesh”:

Clearly the line is descending at a “telling” angle. This makes this strategy crystal clear. Follow that line to the bottom and then watch for a few days (maybe hours) for an upswing. The upswing is the time to buy, but with precautions. The line on that chart should go up again and back down just a bit but never down below where the line crosses the “valley”. It is much safer to buy at this particular valley to be able to make money (sell high) later. You can probably agree, this cryptocurrency trading strategy is a clear winner!

Good cryptocurrency trading strategies recognize markets correctly

After a person learns about trading strategies correctly, things get clearer. It is easier to know the difference between a “bull market” and a “bear market”. Just for pointers, for newbies, a bull market is when the lines on the graph are heading up. Think of the horns of a bull, where do they point? Up. Just like the line on the graph, or “chart”, is pointing up, bull horns also point up. Bear markets on the other hand are when the line on the chart is going down. Bears have claws that point down. Bull horns and bull markets go up. 👍 Bear markets and bear claws go down.

Getting the basics down first

The thing about the trading strategies mentioned on this site is that they are symbiotic. That is, they work in conjunction with other strategies to make them even more useful. Professional traders never use just one trading strategy. They use multiple. Here we have talked about just one that is powerful but still a little bit lonely, so to speak. How do you know when to make the first investment? How do you prevent loss after that? Not to worry. There is much more to learn here about cryptocurrency trading strategies.